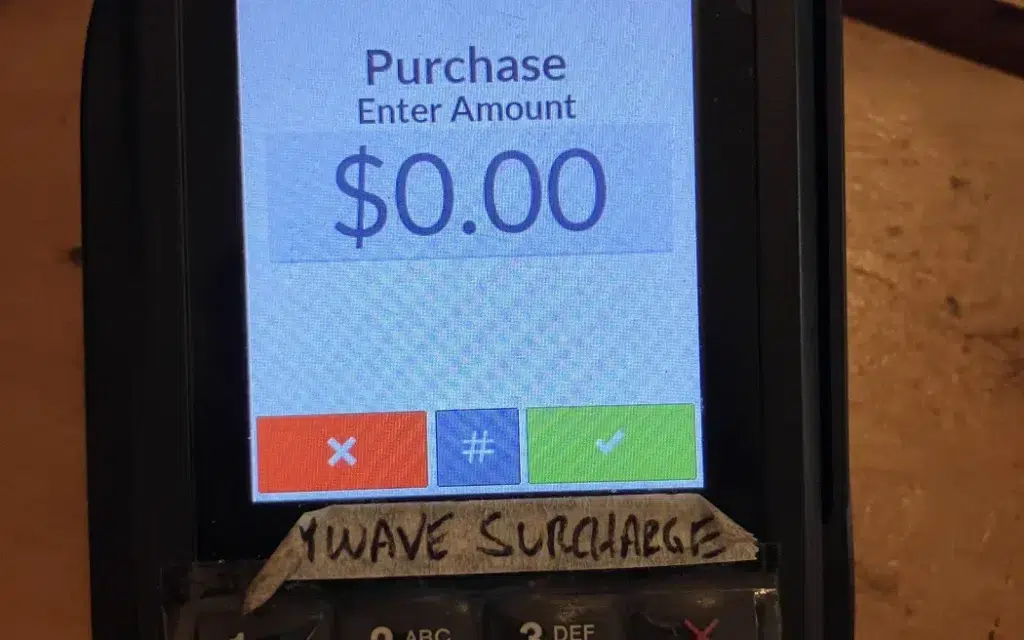

Consumer New Zealand has called on the Commerce Commission to get rid of card payment surcharges due to excessive and hidden fees.

The Commerce Commission is currently reviewing interchange fees to lower merchants’ costs for accepting card payments; however, Consumer NZ said they need to go one step further.

The organisation argues that surcharges should be regulated or removed entirely.

Currently, there are no restrictions on surcharges, only recommended guidelines about transparency and fairness, which are usually ignored.

“The surcharging situation in New Zealand is a mess. We have received hundreds of complaints showing merchants are not complying with the guidelines. It’s time to introduce new surcharge rules,” said Jessica Walker, Consumer NZ’s acting head of research and advocacy.

Currently, some surcharges exceed 20% with estimates suggesting New Zealanders pay between $65 million and $90 million per year in excessive fees.

The organisation argues that banning surcharges would lead to better transparency but also a fairer system and a better customer experience.

Surcharges have already been banned in places such as The United Kingdom and the EU.